The Ultimate Guide to Wellness Scams: What the $7 Trillion Industry is Hiding

Feb 21, 2026

The Wellness Economy: Big Business, Big Claims, and How to Tell the Difference

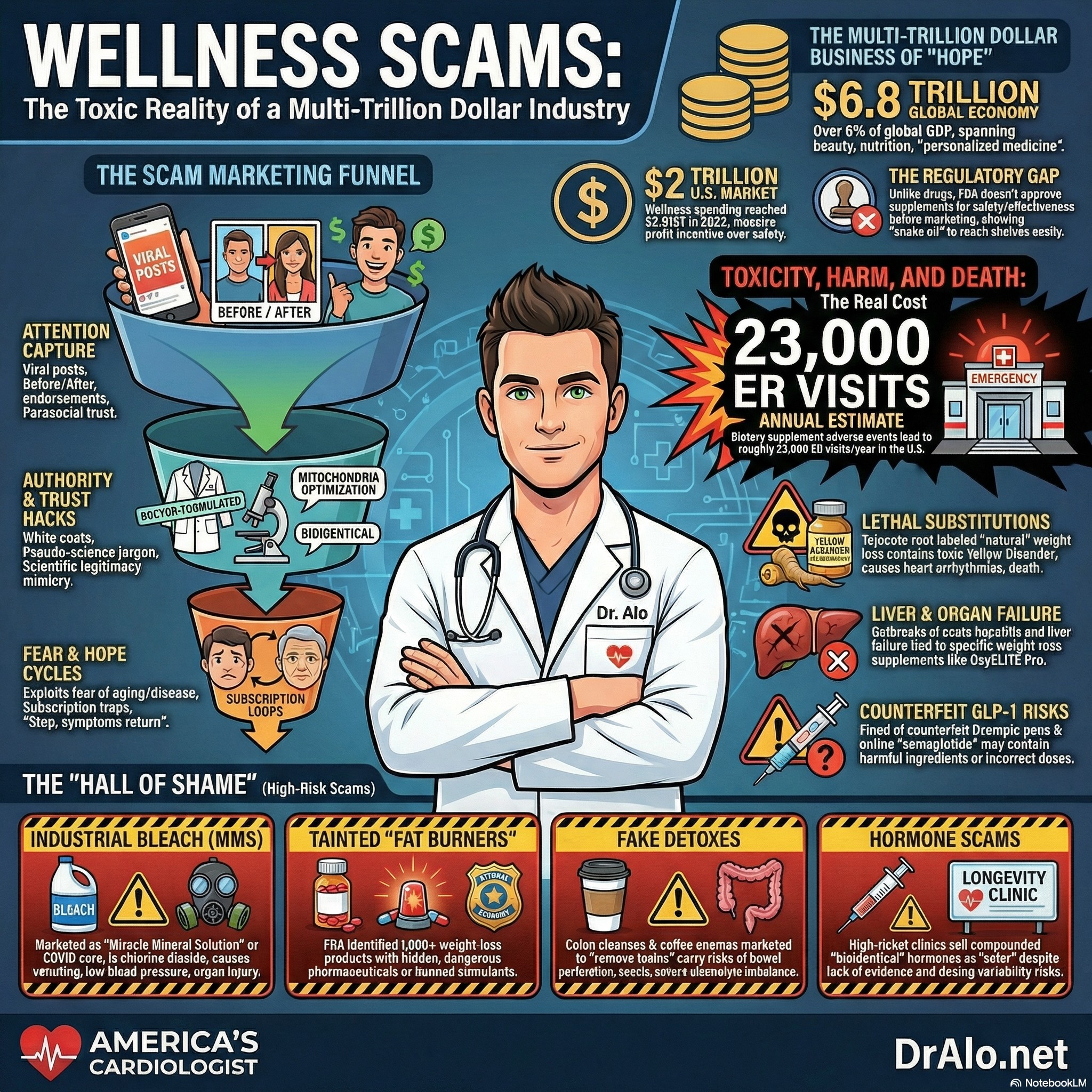

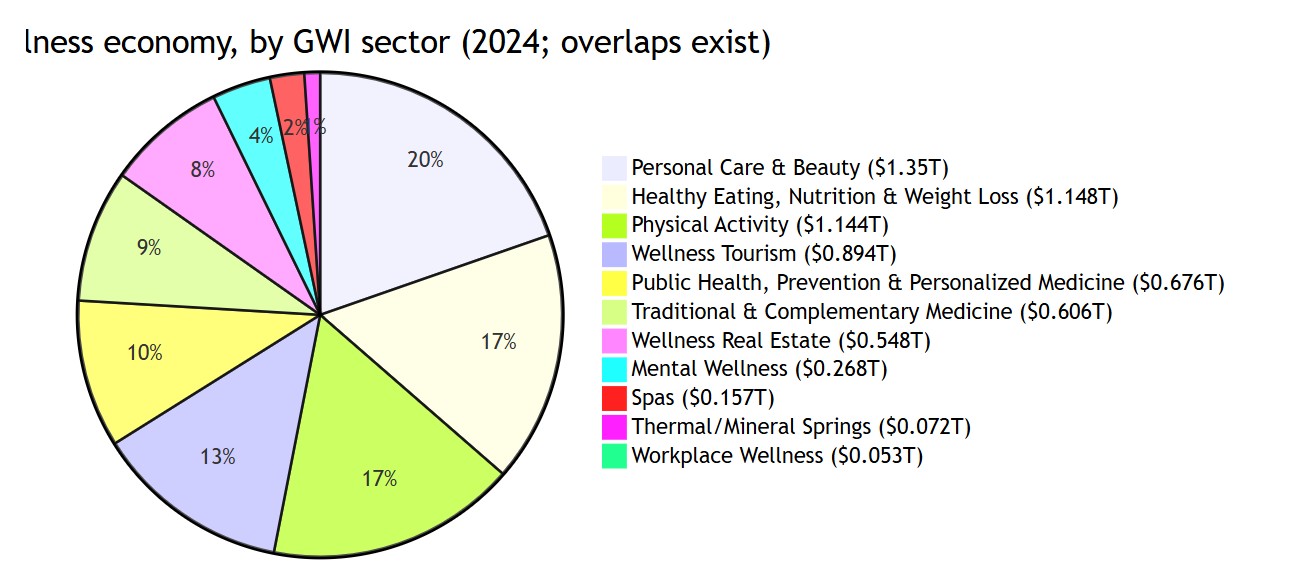

The “wellness industry” is not a single sector, it’s a sprawling ecosystem of products, services, and health-adjacent businesses that range from ordinary self-care (fitness, sleep, nutrition) to highly engineered medical-adjacent offerings (telehealth, diagnostics, hormone clinics) and, unfortunately, to outright fraud. The cleanest high-level estimate I found comes from the Global Wellness Institute: the global wellness economy hit about $6.8 trillion in 2024 and is forecast to approach ~$9.8 trillion by 2029. [1]

Compare that to "Big Pharma" at $500 billion. Most online influencers will criticize Big Pharma for being money hungry, yet completely ignore Big Wellness for being 14X the size of Big Pharma. At least Big Pharma is regulated and must show results. Big Wellness is a free for all and completely unregulated. This is dangerous and has lead to serious harm and even deaths.

In the U.S., GWI estimates wellness spending at about $2.015 trillion in 2023 (latest year in that country report). [2]

Here’s the tension that matters: wellness is huge because parts of it are genuinely useful and widely purchased (beauty/personal care, food/nutrition, physical activity). But the same size and cultural momentum also makes wellness a magnet for overpromising, pseudo-science, and regulatory gray-zone marketing—especially in supplements, weight loss, and “anti-aging.” Regulators repeatedly warn that health claims must be truthful and backed by solid evidence, and they’ve taken real enforcement actions in well-known cases (e.g., deceptive brain-training claims, deceptive weight-loss marketing, influencer disclosure failures). [3]

The harm isn’t only financial. Dietary supplements alo ne have been linked to tens of thousands of U.S. emergency department visits per year in national estimates, and there are documented cases of serious toxicity from mislabeled “natural” weight-loss supplements and from counterfeit/illegal versions of in-demand drugs. Contaminants have even lead to death. [4]

ne have been linked to tens of thousands of U.S. emergency department visits per year in national estimates, and there are documented cases of serious toxicity from mislabeled “natural” weight-loss supplements and from counterfeit/illegal versions of in-demand drugs. Contaminants have even lead to death. [4]

My bottom line: wellness is too big to ignore, but it’s also too lightly governed in many corners to trust by default. The safest approach is to treat wellness claims like you’d treat any health claim: ask “What’s the evidence in humans?”, “What’s the risk if it’s wrong?”, and “Who profits if I believe this?”

How Big Is The Wellness Industry And Who Owns It?

Market size: two different “wellness” numbers can both be true

If you read headlines about wellness, you’ll see different totals because people measure different things.

The Global Wellness Institute (GWI) uses a broad “wellness economy” lens—11 overlapping sectors spanning consumer goods and service industries. In that framework, GWI reports the wellness economy at $6.8T in 2024, growing 7.9% from 2023 to 2024, and notes this represents about 6.12% of global GDP. [5]

A narrower framing (often used by consultants and consumer researchers) focuses on consumer purchases across a subset of categories; it’s useful behaviorally, but it’s not an apples-to-apples replacement for GWI’s macro number. (I’m mentioning this because it explains why one chart says “trillions” and another says “only” the low trillions.) [6]

Market capitalization: there is no single “wellness industry market cap”

Here’s an uncomfortable truth: there is no authoritative, standardized “wellness sector” market-cap figure, because “wellness” is not a clean stock-market classification. Much of wellness spending accrues to diversified giants (food, beauty conglomerates, big tech wearables, hospitality) and to private companies. [5]

What I can do rigorously is show a proxy basket of public “wellness-forward” companies and their market caps at specific dates (to illustrate scale and volatility). This does not equal “the wellness industry,” but it shows how public markets price some pure-play-ish wellness models.

|

Illustrative public company |

What it represents in wellness |

Market cap snapshot (as of Feb 2026) |

|

Planet Fitness |

Gyms / mass-market fitness memberships |

~$7.75B (Feb 10, 2026) [7] |

|

Hims & Hers Health |

DTC telehealth + subscriptions |

~$3.62B (Feb 19, 2026) [8] |

|

Peloton |

Connected fitness hardware + subscription content |

~$1.81B (Feb 13, 2026) [9] |

|

Herbalife |

Supplements sold via multi-level marketing |

~$2.02B (Feb 19, 2026) [10] |

If you sum many companies like these, you still won’t “reconstruct” the wellness economy—because (a) a lot of wellness is private, and (b) giant mixed businesses don’t break out “wellness” in a way you can cleanly market-cap. [5]

Where the Money Flows Across Wellness Categories

I like to think of wellness as “what people buy when they’re trying to feel better, look better, live longer, or take control.” That maps neatly onto big categories—some more evidence-based than others—and it also helps explain why scams cluster in certain places (weight loss, “detox,” anti-aging, immune claims).

Market size by category

The table below mixes (1) GWI’s wellness economy sectors (very large, overlapping, macro) and (2) category-level market research estimates (more specific, often non-overlapping within their own definitions). I’m keeping years explicit because “latest” varies by source.

|

Category |

What it typically includes |

Market size (global) |

U.S. market size (where available) |

Notes |

|

Total wellness economy (GWI) |

11-sector “wellness economy” |

$6.8T (2024) [5] |

$2.015T (2023) [2] |

Sectors overlap; not strictly additive [11] |

|

Personal care & beauty (GWI sector) |

Cosmetics, skincare, etc. |

$1.35T (2024) [11] |

Unspecified |

Sector, not device-only |

|

Healthy eating, nutrition & weight loss (GWI sector) |

Food + weight loss ecosystem |

$1.148T (2024) [11] |

Unspecified |

Sector overlaps supplements/foods |

|

Physical activity (GWI sector) |

Gyms, sport, equipment, studios |

$1.144T (2024) [11] |

Unspecified |

Broad, service heavy |

|

Wellness tourism (GWI sector) |

Travel tied to wellness activities |

$894B (2024) [11] |

Unspecified |

GWI value; other firms differ |

|

Spas (GWI sector) |

Day spas, resort spas, etc. |

$157B (2024) [11] |

Unspecified |

Service-based |

|

Thermal/mineral springs (GWI sector) |

Hot springs establishments |

$72B (2024) [12] |

Unspecified |

GWI estimates establishment count + revenue [12] |

|

Supplements |

Vitamins, botanicals, sports nutrition |

$192.65B (2024) [13] |

Unspecified (CAGR noted) [13] |

High scam exposure category [14] |

|

Functional foods |

Foods marketed with added benefits |

$329.65B (2023) [15] |

Unspecified |

Often overlaps “healthy eating” sector |

|

Wearables |

Watches, rings, trackers, smart eyewear |

$92.90B (2025) [16] |

$19.92B (2023) [17] |

Also privacy/behavioral-risk issues |

|

Beauty tech / devices |

Skincare devices + AI/AR beauty tech |

$66.16B (2024) [18] |

Unspecified |

Some devices have limited proven benefit [19] |

|

Anti-aging products |

Mostly consumer skincare anti-aging |

$52.44B (2024) [20] |

$14.05B (2024) [21] |

Not the same as “longevity clinics” |

|

Telehealth |

Remote care platforms/services |

$123.26B (2024) [22] |

Unspecified |

Definitions vary (“telehealth” vs “telemedicine”) [23] |

|

mHealth apps |

Fitness + medical apps |

$37.5B (2024) [24] |

Unspecified in snippet |

Subscriptions + habit loops |

|

Self-testing |

OTC tests, home kits, devices, strips |

$11.39B (2024) [25] |

Unspecified |

Can be helpful; also anxiety-driven upsell risk |

|

DTC genetic testing |

Consumer genetic testing kits |

$1.9B (2023) [26] |

Unspecified |

Often bundled into “personalization” |

|

Weight-loss services |

Programs, services (not drugs) |

$36.31B (2023) [27] |

Unspecified |

High marketing intensity |

|

Saunas (equipment market) |

Sauna products/equipment |

$904.9M (2024) [28] |

Unspecified |

Distinct from sauna-as-service |

Big Wellness Quick Market-share Picture

GWI’s sector values are a good way to visualize “where the biggest piles of money are.” This pie chart uses GWI’s 2024 sector numbers as presented; note the caveat: sectors can overlap, so treat this as “relative scale,” not a perfect decomposition. [11]

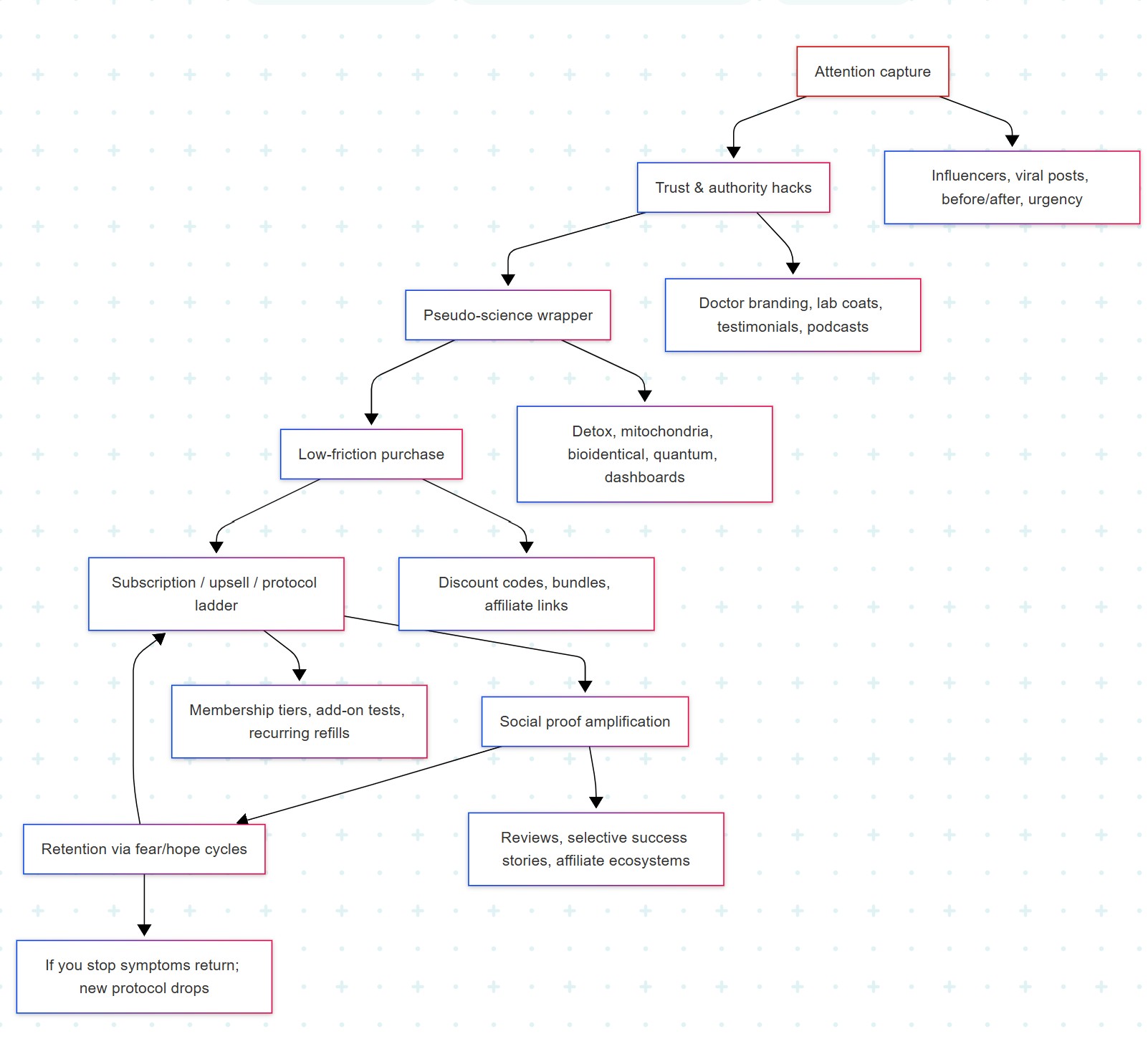

How Wellness Companies Make Money and Sell Hope

When I look across wellness, the same “growth playbook” appears again and again. Some of it is normal business (subscriptions, retention, product bundling). Some is more troubling: making claims that feel scientific but don’t meet scientific standards.

The rules that matter

In the U.S., two agencies set much of the practical boundary:

The FTC focuses on deceptive marketing. For health-related claims, it generally expects competent and reliable scientific evidence supporting what you imply to reasonable consumers. [29]

The FDA regulates drugs and also oversees dietary supplements in a different framework; it also warns that many products marketed as supplements have been found with hidden drug ingredients, and it maintains multiple fraud notification systems. [30]

Business models vs marketing tactics

|

Business model (how money is made) |

Typical revenue mechanics |

Common marketing tactics |

Where it can go wrong (pattern) |

|

DTC supplements |

High margin; bundles; repeat purchase |

“Doctor formulated,” before/after, “supports” language |

Evidence gap; “tainted” products with hidden drugs; misleading disease implications [14] |

|

MLM supplements |

Distributor recruitment + product sales |

Community identity; transformation stories; income promises |

Deceptive earnings potential; peer pressure; high churn [31] |

|

Subscription apps (sleep, fitness, “brain training”) |

Recurring revenue; long retention |

“Personalized,” streaks, gamification |

Claims outpacing evidence; placebo-like engagement framed as medical benefit [32] |

|

Connected devices (wearables, LED masks) |

Hardware + membership/saaS |

Quantified-self, “biohacking,” influencer unboxings |

“Wellness” positioning while implying disease detection/treatment; device quality variance [33] |

|

Telehealth & online clinics |

Membership + Rx/fulfillment |

Convenience, privacy, “optimized care” |

Overprescribing, thin screening; compounding gray zones in hot areas (e.g., GLP‑1 demand) [34] |

|

“Longevity” / hormone clinics |

High-ticket memberships, add-on labs |

“Optimization,” “bioidentical,” lab-driven authority |

Weak evidence for some claims; compounded hormone risks/uncertainty [35] |

|

Retreats/spas/thermal |

Packages, experiences, add-ons |

“Detox,” “reset,” transformation narratives |

Selling vague “toxins” removal; upselling unproven medical-like add-ons [36] |

The Wellness Scam Marketing Funnel I Keep Seeing

A big accelerant here is influencer marketing. The FTC updated its Endorsement Guides to address new realities like social media endorsements and deceptive reviews—because these channels can blur the line between testimony and evidence. [37]

Consumer Harms: What’s Documented and Why It Happens

When wellness goes wrong, the harm usually falls into four buckets:

Financial harm (wasted money, subscription traps, high-ticket protocols), health harm (toxicity, interactions, counterfeit products), opportunity cost (delayed diagnosis or treatment), and misinformation (false beliefs that drive bad decisions).

Documented health harm: supplements and counterfeits are the sharp edge

A national estimate based on U.S. surveillance data reported over 20,000 emergency department visits per year attributed to dietary supplement adverse events, with many involving weight-loss/energy products in younger adults and swallowing issues in older adults. [38]

That’s the “ordinary” harm: side effects, interactions, dosing mistakes. Then there’s the “catastrophic” harm: outright toxicity and fraud.

Case study: mislabeled weight-loss supplements containing a toxic plant (yellow oleander).

The CDC described “tejocote root” products for weight loss that testing found were actually yellow oleander, containing digoxin-like cardiac toxins—an example of how “natural” branding can hide lethal risk. [39]

Case study: counterfeit Ozempic and illegal GLP‑1 knockoffs.

The FDA has issued repeated warnings about counterfeit Ozempic found in the U.S. supply chain and continues investigating seized counterfeit units. [40]

Separately, the FDA warns that unapproved GLP‑1 drugs sold for weight loss are risky because they don’t undergo FDA review for safety/quality and may involve compounding misuse and misleading marketing. [41]

In Europe, the EMA has also warned about falsified Ozempic pens circulating through wholesalers. [42]

Opportunity Cost: The Harm You Don’t See In Receipts

Even when the “protocol” is physically safe, it can still be harmful if it replaces effective care. A peer-reviewed study in JNCI found worse outcomes for certain cancer patients who used alternative medicine instead of conventional cancer treatment. [43]

Misinformation Harm: “detox” and “immune booster” claims spread fast

The FDA maintains a public page on fraudulent COVID-19 products marketed to prevent, treat, diagnose, or cure COVID-19 and documents warning letter activity. [44]

And the FDA warns consumers about “Miracle Mineral Solution” (chlorine dioxide), a bleach-like substance marketed as a medical treatment, due to dangerous side effects. [45]

Scam and Overclaim Catalog: Evidence, Enforcement, and Risk

I’m going to be blunt: not everything below is “fake” in the sense of having zero biological effect. Some items (like red-light therapy and sauna bathing) have plausible mechanisms and some evidence for certain outcomes—but they’re commonly marketed in ways that exceed what the evidence supports, or they’re bundled into “detox” myths.

Scams table: what’s claimed vs what evidence and regulators say

|

Product/practice |

Common claim |

Evidence snapshot |

Regulatory status / actions |

Consumer harm pattern |

Key sources |

|

Fake GLP‑1s / illegal “semaglutide” online |

“Real GLP‑1 weight loss without a legit Rx” |

Unapproved versions lack FDA review; risk of poor quality/incorrect formulation |

FDA warns against unapproved GLP‑1 drugs used for weight loss |

Unknown contents, dosing errors, delayed proper care |

|

|

Counterfeit Ozempic |

“Same drug, cheaper” |

FDA investigating thousands of seized counterfeit units; safety/identity uncertain |

FDA counterfeit warnings; EMA alerts in EU |

Infection risk, ineffective product, toxic adulterants |

|

|

Weight-loss pills/fat burners |

“Melt fat, boost metabolism fast” |

FDA has extensive fraud notices; weight-loss products often implicated in hidden-ingredient problems |

FDA weight-loss fraud notifications; “tainted products” alerts |

CV side effects, interactions, hidden stimulants/drugs |

|

|

“Tejocote root” / “Nuez de la India” (mislabeled) |

“Natural weight loss” |

CDC found products substituted with yellow oleander toxins |

CDC report; FDA follow-up advisory/testing |

Arrhythmias, poisonings, hospitalization |

|

|

Detoxes/cleanses |

“Remove toxins; reset body; rapid weight loss” |

NCCIH: “detox” claims are broad; evidence varies; some regimens can be harmful |

Mostly consumer-protection issue unless disease claims |

Dehydration, malnutrition, disordered eating, false reassurance |

|

|

Colon cleanses/colonics/enemas marketed as detox |

“Clean out the colon; fix fatigue/immunity” |

Major medical sources warn of risks and lack of need |

Not FDA-approved as detox; often marketed outside medical supervision |

Perforation, infection, electrolyte imbalance |

|

|

Blue-light blocking glasses |

“Prevent eye damage; fix digital eye strain; improve sleep” |

Cochrane review: little/no short-term benefit for eye strain; AAO doesn’t recommend for eye health claims |

Not typically an enforcement focus unless deceptive ads |

Mostly financial harm; distraction from proven habits |

|

|

Red-light / LED masks |

“Erase wrinkles; cure acne; reverse aging” |

Dermatology orgs say it may help as adjunct for certain issues; at-home devices weaker; not a miracle |

Some devices are FDA-cleared for limited indications; still many overclaims |

Financial harm; eye safety issues if misused |

|

|

“Mitochondria health” stacks (NAD+ IVs, boosters) |

“Boost cellular energy; reverse aging; treat addiction” |

Emerging research; evidence often preliminary; some claims (e.g., addiction “detox cure”) not established |

Some regulators have acted on clinics’ unsubstantiated claims (reported) |

High cost; IV risks; vulnerable people targeted |

|

|

Grounding mats |

“Absorb electrons; reduce inflammation; improve sleep” |

Some small/pilot trials exist; overall body of evidence is limited and contested |

Generally unregulated unless medical claims cross line |

Mostly opportunity cost/false confidence; sometimes electrical safety concerns |

|

|

Hydrogen water |

“Powerful antioxidant; anti-inflammatory; performance and longevity boost” |

Systematic reviews describe mixed/early evidence; clinical certainty remains limited |

Often sold as beverage/device; disease claims may draw scrutiny |

Mostly financial/opportunity cost; hype-driven overuse |

|

|

“Mother water” / “structured/hexagonal/quantum” water |

“Restructure water; heal better hydration/energy” |

Chemistry experts argue claims are misleading; “water is water” framing |

Usually consumer-protection territory unless disease claims |

Financial harm; misinformation |

|

|

Perineum sunning |

“Boost testosterone/energy; ‘ancient’ wellness” |

Paper documents this as non–evidence-based with potential harm; UV exposure risk |

Not a product enforcement case; public-health messaging matters |

Burns, skin cancer risk, “viral trend” harm |

|

|

Bogus immune boosters |

“Boost immunity; prevent infections; cure serious disease” |

Regulators maintain fraud databases; many products make illegal disease claims |

FDA health fraud product database; COVID fraud pages |

Delayed care, toxicity (if adulterated), misinformation |

|

|

COVID “reversal” protocols (incl. MMS/chlorine dioxide) |

“Treat/cure COVID” |

FDA warns of dangerous side effects from chlorine dioxide products |

FDA warnings + enforcement actions |

Poisoning, severe illness; high misinformation risk |

|

|

Hormone scams (compounded “bioidentical” HRT as “safer/natural”) |

“Safer, more effective, personalized hormones” |

Endocrine Society: little/no evidence supports superiority claims; ACOG cites lack of high-quality evidence |

Clinical guidance discourages routine use when approved products exist |

Dosing variability, risks, medicalization/overuse |

|

|

Herbal miracle cures (especially cancer) |

“Treat/cure cancer naturally” |

FDA documents warning letters and products sold illegally for cancer claims |

FDA “Illegally sold cancer treatments” page |

Delay of effective care; financial exploitation |

Top scams to worry about first (prevalence × harm)

If I had to prioritize what’s most dangerous at scale, I’d put these at the top:

- Illegal/counterfeit GLP‑1 weight-loss drugs and compounded knockoffs marketed irresponsibly, because demand is huge and the risk profile includes wrong ingredients, wrong dosing, and infections. [61]

- Weight-loss supplements and “fat burners”, because regulators repeatedly warn of contamination and hidden drugs in this category, and because adverse events are well documented. [62]

- Mislabeled “herbal” weight-loss products (yellow oleander substitution), because the harm can be acute and cardiac. [39]

- COVID “cure” products and bleach-like protocols (MMS/chlorine dioxide), because the claims can deter real medical care and the products can be toxic. [58]

- High-ticket hormone “optimization” via compounded bioidentical hormones positioned as safer, because professional societies highlight evidence gaps and risks when FDA-approved options exist. [35]

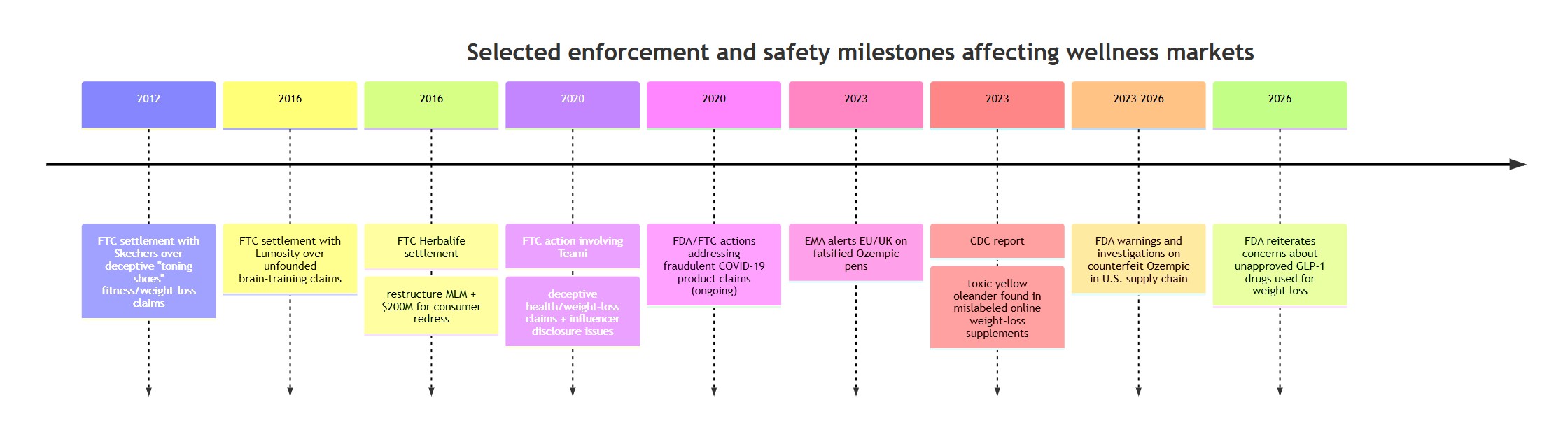

A timeline of major enforcement and warning signals

This isn’t exhaustive, but it shows how wellness-adjacent enforcement tends to spike around big consumer trends (weight loss, cognitive enhancement, COVID, influencer marketing).

Where Saunas Fit: Real Benefits, Real Risks, and Real Marketing Nonsense

Saunas are a good example of “wellness that’s not automatically a scam.” There is a serious scientific literature on sauna bathing and health, including cardiovascular associations and plausible physiological mechanisms; Mayo Clinic Proceedings published a review summarizing evidence across outcomes. [64] However, it is generally way overstated and most studies are confounded by healthy user bias. Most people who are healthy enough to use a sauna three to four times per week are very wealthy and healthy to begin with compared those who can't.

But saunas also get dragged into detox mythology (“sweat out toxins”) and into risky “wellness stacking” (alcohol + heat + dehydration). From a safety perspective, heat illness risk is real, and public-health agencies emphasize recognizing overheating symptoms and preventing dehydration—principles that apply to sauna use too. [65]

Sources and further reading

Key industry sizing and category reports

GWI “Statistics & Facts” (global wellness economy in 2024; growth; share of global GDP) [66]

GWI Global Wellness Economy Monitor 2025 PDF (sector sizes; methodology; trends) [11]

GWI U.S. wellness economy report PDF (U.S. spending, 2019–2023) [2]

Grand View Research category market sizing

Dietary supplements market size (global) [13]

Functional foods market size (global) [15]

Wearable technology market size (global) and U.S. wearable market size [67]

Beauty tech market size (global) [18]

Anti-aging products market size (global) and U.S. anti-aging market size [68]

Telehealth market size (global) [22]

mHealth apps market size (global) [24]

Self-testing market size (global) [25]

Sauna equipment market size (global) [28]

Regulatory and enforcement sources

FTC Health Products Compliance Guidance [29]

FTC updated Endorsement Guides press release [37]

FTC: Lumosity settlement [32]

FTC: Herbalife settlement and refunds [31]

FTC: Teami case (claims + influencer marketing) [69]

FTC: Skechers toning shoes settlement [70]

FDA: Counterfeit Ozempic warning [71]

EMA: Falsified Ozempic pens alert [42]

FDA: Concerns with unapproved GLP‑1 drugs used for weight loss [41]

FDA: Medication health fraud notifications; tainted products with hidden ingredients [72]

FDA: Fraudulent COVID-19 products [44]

FDA: Miracle Mineral Solution warning (chlorine dioxide) [45]

Peer-reviewed and medical evidence sources for specific items

Emergency department visits for dietary supplement adverse events (NEJM / CDC-hosted material) [38]

CDC MMWR: Tejocote root substituted with yellow oleander [73]

Cochrane review: blue-light filtering spectacle lenses [74]

American Academy of Ophthalmology: blue-light glasses not recommended for eye health claims [75]

American Academy of Dermatology: red light therapy guidance [19]

JMIR Dermatology: perineum sunning analysis [56]

Mayo Clinic Proceedings: sauna bathing review [76]

CDC heat illness guidance (overheating symptoms/safety framing) [65]

Endocrine Society position statement: compounded bioidentical hormone therapy evidence gap [77]

ACOG clinical consensus: compounded bioidentical menopausal hormone therapy evidence limitations [78]

National Academies report on compounded bioidentical hormone therapy [79]

[1] [5] [66] Statistics & Facts - Global Wellness Institute

https://globalwellnessinstitute.org/press-room/statistics-and-facts/

[2] The Global Wellness

https://www.globalwellnesssummit.com/wp-content/uploads/2025/02/GWI-WE-US-2025_022125_FINAL.pdf

[3] [29] Health Products Compliance Guidance - Federal Trade Commission

https://www.ftc.gov/business-guidance/resources/health-products-compliance-guidance

[4] Slide 1

https://www.nejm.org/cms/asset/08e3154c-892b-41e1-ae91-1e6d6cd91c7e/nejmsa1504267.pptx

[6] The Future of Wellness trends survey 2025 | McKinsey

https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/future-of-wellness-trends

[7] Planet Fitness Market Cap 2014-2025 | PLNT - Macrotrends

https://www.macrotrends.net/stocks/charts/PLNT/planet-fitness/market-cap

[8] Hims & Hers Health (HIMS) Market Cap & Net Worth - Stock Analysis

https://stockanalysis.com/stocks/hims/market-cap/

[9] Peloton Interactive (PTON) Market Cap & Net Worth - Stock Analysis

https://stockanalysis.com/stocks/pton/market-cap/

[10] Herbalife (HLF) Market Cap & Net Worth - Stock Analysis

https://stockanalysis.com/stocks/hlf/market-cap/

[11] Global Wellness ECONOMY MONITOR

https://globalwellnessinstitute.org/wp-content/uploads/2025/11/2025-GWI-WE-Monitor_DIGITAL-FINAL.pdf

[12] THERMAL/MINERAL SPRINGS - Global Wellness Institute

https://globalwellnessinstitute.org/what-is-wellness/thermal-mineral-springs/

[13] Dietary Supplements Market Size | Industry Report, 2033

https://www.grandviewresearch.com/industry-analysis/dietary-supplements-market-report

[14] [30] Tainted Products Marketed as Dietary Supplements and Foods ...

https://www.fda.gov/media/186556/download

[15] Functional Foods Market Size & Trends Analysis Report, 2030

https://www.grandviewresearch.com/industry-analysis/functional-food-market

[16] [67] Wearable Technology Market Size | Industry Report, 2033

https://www.grandviewresearch.com/industry-analysis/wearable-technology-market

[17] U.S. Wearable Technology Market | Industry Report, 2030

https://www.grandviewresearch.com/industry-analysis/us-wearable-technology-market-report

[18] Beauty Tech Market Size And Share | Industry Report, 2030

https://www.grandviewresearch.com/industry-analysis/beauty-tech-market-report

[19] [33] [51] Is red light therapy right for your skin? - American Academy of Dermatology

https://www.aad.org/public/cosmetic/safety/red-light-therapy

[20] [68] Anti-Aging Products Market Size | Industry Report, 2030

https://www.grandviewresearch.com/industry-analysis/anti-aging-products-market

[21] U.S. Anti-aging Products Market Size | Industry Report, 2033

https://www.grandviewresearch.com/industry-analysis/us-anti-aging-products-market-report

[22] Telehealth Market Size, Share, Trends | Industry Report 2030

https://www.grandviewresearch.com/industry-analysis/telehealth-market-report

[23] Telemedicine Market Size And Share | Industry Report, 2030

https://www.grandviewresearch.com/industry-analysis/telemedicine-industry

[24] mHealth Apps Market Size & Share | Industry Report, 2030

https://www.grandviewresearch.com/industry-analysis/mhealth-app-market

[25] Self-testing Market Size And Share | Industry Report, 2030

https://www.grandviewresearch.com/industry-analysis/self-testing-market-report

[26] Direct-to-Consumer Genetic Testing Market Size Report 2030

https://www.grandviewresearch.com/industry-analysis/direct-to-consumer-genetic-testing-market-report

[27] Weight Loss Services Market Size & Share Report, 2030 - Grand View Research

https://www.grandviewresearch.com/industry-analysis/weight-loss-services-market

[28] Sauna Market Size, Share & Growth | Industry Report, 2033

https://www.grandviewresearch.com/industry-analysis/sauna-market-report

[31] Herbalife Will Restructure Its Multi-level Marketing Operations and Pay ...

[32] Lumosity to Pay $2 Million to Settle FTC Deceptive Advertising Charges ...

[34] It's Shockingly Easy to Buy Off-Brand Ozempic Online, Even if You Don't Need It

[35] [59] [77] Compounded Bioidentical Hormone Therapy - Endocrine Society

https://www.endocrine.org/advocacy/position-statements/compounded-bioidentical-hormone-therapy

[36] [48] “Detoxes” and “Cleanses”: What You Need To Know | NCCIH

https://www.nccih.nih.gov/health/detoxes-and-cleanses-what-you-need-to-know

[37] Federal Trade Commission Announces Updated Advertising Guides to Combat ...

[38] Emergency Department Visits for Adverse Events Related to Dietary ...

https://stacks.cdc.gov/view/cdc/59924

[39] [73] Notes from the Field: Online Weight Loss Supplements...

https://www.cdc.gov/mmwr/volumes/72/wr/mm7237a3.htm

[40] [46] [71] FDA warns consumers not to use counterfeit Ozempic (semaglutide) found

[41] [61] FDA’s Concerns with Unapproved GLP-1 Drugs Used for Weight Loss

[42] EMA alerts EU patients and healthcare professionals to reports of ...

[43] https://www.grandviewresearch.com/industry-analysis/dietary-supplements-market-report

https://www.grandviewresearch.com/industry-analysis/dietary-supplements-market-report

[44] Fraudulent Coronavirus Disease 2019 (COVID-19) Products | FDA

[45] [58] FDA warns consumers about the dangerous and potentially life ...

[47] [62] [72] Medication Health Fraud Notifications | FDA

https://www.fda.gov/drugs/medication-health-fraud/medication-health-fraud-notifications

[49] Colon cleansing: Is it helpful or harmful? - Mayo Clinic

[50] [74] Blue-light filtering spectacle lenses for visual performance ... - Cochrane

[52] Intravenous infusion of nicotinamide adenine dinucleotide (NAD

https://www.frontiersin.org/journals/aging/articles/10.3389/fragi.2026.1652582/full

[53] A randomized, double-blind, placebo-controlled study on the improvement ...

https://www.sciencedirect.com/science/article/pii/S2212958825000059

[54] Hydrogen Water: Extra Healthy or a Hoax?—A Systematic Review - MDPI

https://www.mdpi.com/1422-0067/25/2/973

[55] Don’t fall for the snake oil claims of ‘structured water’. A chemist ...

[56] JMIR Dermatology - Public Interest in a Potentially Harmful, Non ...

https://derma.jmir.org/2021/1/e24124

[57] Health Fraud Product Database | FDA

https://www.fda.gov/consumers/health-fraud-scams/health-fraud-product-database

[60] Illegally Sold Cancer Treatments | FDA

https://www.fda.gov/consumers/health-fraud-scams/illegally-sold-cancer-treatments

[63] [70] Skechers Will Pay $40 Million to Settle FTC Charges That It Deceived ...

[64] [76] Cardiovascular and Other Health Benefits of Sauna Bathing: A Review of ...

https://www.mayoclinicproceedings.org/article/s0025-6196%2818%2930275-1/fulltext

[65] About Heat and Your Health | Heat Health | CDC

https://www.cdc.gov/heat-health/about/index.html

[69] FTC’s Teami case: Spilling the tea about influencers and advertisers

[75] Are Blue Light-Blocking Glasses Worth It? - American Academy of ...

https://www.aao.org/eye-health/tips-prevention/are-computer-glasses-worth-it

[78] Compounded Bioidentical Menopausal Hormone Therapy - ACOG

[79] The Clinical Utility of - nationalacademies.org

https://www.nationalacademies.org/read/25791?utm_source=chatgpt.co

Still Have Questions? Stop Googling and Ask Dr. Alo.

You’ve read the science, but applying it to your own life can be confusing. I created the Dr. Alo VIP Private Community to be a sanctuary away from social media noise.

Inside, you get:

-

Direct Access: I answer member questions personally 24/7/365.

-

Weekly Live Streams: Deep dives into your specific health challenges.

-

Vetted Science: No fads, just evidence-based cardiology and weight loss.

Don't leave your heart health to chance. Get the guidance you deserve. All this for less than 0.01% the cost of health insurance! You can cancel at anytime!

[👉 Join the Dr. Alo VIP Community Today]